We are your trusted M&A Advisor for both sell-side and buy-side opportunities. Are you looking to exit or acquire an accretive business? Let us help you unlock your full potential.

Let's TalkOur team is composed of experienced corporate development and investment banking professionals with hundreds of deals in their collective background, alongside a skilled research team. We use proven methodologies and playbooks to help drive successful outcomes.

Novell’s north star is corporate growth and successful deal execution. We support corporations, Private Equity firms, and Family Offices in their effort to grow through sound corporate strategy and inorganic growth opportunities. And when it is time to exit, we are right by your side. Our company employs simple, effective, and proven playbooks and methodologies to ensure our clients achieve consistent and measurable results.

Think of the Novell team as a flexible extension of your internal resources. We help you develop new theses, build a proprietary target pipeline, and deliver comprehensive research and commercial due diligence. Finally, we support your deal execution from start to finish.

Strategic/Corporate Acquirers

Private Equity Firms

Family Offices

Companies Seeking Funding/Exit Opportunities

US/Canada/Europe

Technology

Software/Enterprise SaaS

Industrial Technology

Wireless/Satellite Communication

Energy and Sustainability

Environmental Services

Manufacturing

Position, Navigation and Timing

Logistics

Novell's corporate development partnership enhances and supports your growth through a strategic approach to inorganic growth, joint ventures, and alliances.

Novell supports PE and Family Office platforms with add-on strategies. We work with PortCo leadership to drive a proprietary pipeline, conduct deep-dive research, perform commercial due diligence, and execute deals.

At Novell, we continuously scan markets for promising investment theses. We support PE and Family Offices in both thesis development and execution.

Through our extensive investor network, we connect some of the world's top entrepreneurs with the right mix of funding opportunities. And, when the time is right, we also help them find the right exit strategy.

Novell supports the process of strategy development. With a career in corporate strategy and with insights from his teaching at Stanford Graduate School of Business, our founder brings a wealth of expertise to guide companies in shaping and executing their strategic vision.

Novell leads or partners in corporate development, creating a proprietary execution plan for each engagement.

Strategy review with the client's leadership team. We define an M&A strategy, including broad investment criteria, based on the corporate strategy.

Novell’s efficient research team will create and refine a target pipeline based on predefined criteria. Our team will analyze and engage potential targets, exploring deal options. We conduct comprehensive commercial due diligence on client-selected prime targets.

When a deal is identified, Novell manages execution using proven playbooks, including valuation, negotiation, due diligence, legal agreements, and more. Throughout the process, we collaborate with our clients to tailor these playbooks to their unique needs, fostering organizational learning and enhancing preparedness for future deals.

Novell supports integration planning focused on key value-creation drivers. While we are not Post-Merger Integration experts, we ensure a smooth transition from deal execution to integration.

Novell leads or partners in corporate development, creating a proprietary execution plan for each engagement.

Strategy review with the client's leadership team. We define an M&A strategy, including broad investment criteria, based on the corporate strategy.

Novell’s efficient research team will create and refine a target pipeline based on predefined criteria. Our team will analyze and engage potential targets, exploring deal options. We conduct comprehensive commercial due diligence on client-selected prime targets.

When a deal is identified, Novell manages execution using proven playbooks, including valuation, negotiation, due diligence, legal agreements, and more. Throughout the process, we collaborate with our clients to tailor these playbooks to their unique needs, fostering organizational learning and enhancing preparedness for future deals.

Novell supports integration planning focused on key value-creation drivers. While we are not Post-Merger Integration experts, we ensure a smooth transition from deal execution to integration.

Partnering with Novell grants you immediate access to a vast investor and industry network built over decades of deal-making experience.

With Novell, you gain access to a proven playbook for deal sourcing, due diligence, negotiations, and overall deal management.

We leverage the latest technologies, including AI, to enhance proprietary deal-sourcing, manage target pipelines, and streamline deal execution.

Novell has access to the best available data sources, allowing our researchers to find comprehensive target and comps data. We go further by engaging with target management to gain a deeper understanding of the opportunity.

For PortCos too busy with day-to-day operations, we serve as their strategically aligned partner for sourcing and executing add-on deals. Novell works at a pace and intensity tailored to the company’s needs, ensuring deal-making is perfectly timed for optimal results.

We aim for long-term engagement, positioning ourselves not just as deal-hunters, but as integral partners in our clients' growth journey.

In sectors where Novell has specialized knowledge, we have a proven track record of developing ready-to-execute investment theses. Novell conducts in-depth research to validate thesis assumptions before our investment manager clients make a full commitment.

Novell’s founder and key managers have built their careers in deal-making and entrepreneurship. Leveraging our extensive network, we help companies secure funding, including acquisition financing. We also assist companies in preparing for and identifying exit opportunities.

Leveraging the latest methodologies from leading experts in corporate strategy, we facilitate both strategy formation and execution. Our strategy projects are built on proven, customized, and iterative playbooks, ensuring a strategy that delivers results.

“We worked jointly with Novell to support a large enterprise customer with a strategic review of a specific market segment. Our work included market analysis, acquisition target review and strategy, financial analysis of potential targets, and valuation modeling. Novell did a great job supporting us and our client.”

“We have worked with Novell for several years, primarily on our corporate strategy, including reviewing our funding and long-term exit scenarios. Novell has also supported us with market analysis and partnership development. I can honestly say that they put their clients first in all of their interactions, and we can give them our highest recommendation.”

“When divesting our fleet management business, Novell did a great job researching the market and finding potential landing spots for this business unit. Ultimately, they negotiated a successful deal for us, and supported us throughout the project execution”.

“"As we, at Matternet, tried to understand how to best deploy our systems at scale, we brought in Novell to help us model different deployment scenarios and paths to scale," said Andreas Raptopoulos, CEO of Matternet. "Through their systems-thinking approach, they helped us develop new concepts for modelling our deployments and assessing our financial performance. I highly recommend Novell for their business acumen, strategic thinking and strong skills in financial modelling.”

"With their deep industry expertise, Novell was able to help us find a buyer for Qulsar's business of network timing system products. From developing a list of potential acquirers to engaging the market and, ultimately, negotiating an acceptable deal to sell the this business area and related technologies, Novell provided excellent transaction support from start to finish."

Novell advises on sale of Qulsar assets

Novell Corporate Development is happy to announce our support for the Qulsar, Inc. (www.qulsar.com) sale of assets to Viavi Solutions, Inc (www.viavisolutions.com). The asset purchase includes all Qulsar Systems Qg 2 variants and related development activities.

Novell support financial and deployment modeling for global leader in drone deliveries

At Matternet we design, build and operate drone delivery systems for the cities of the future. Over the last year, we’ve experienced an inflection point in the demand for our systems, driven by the need for fast and sustainable on-demand delivery in dense urban environments around the world.

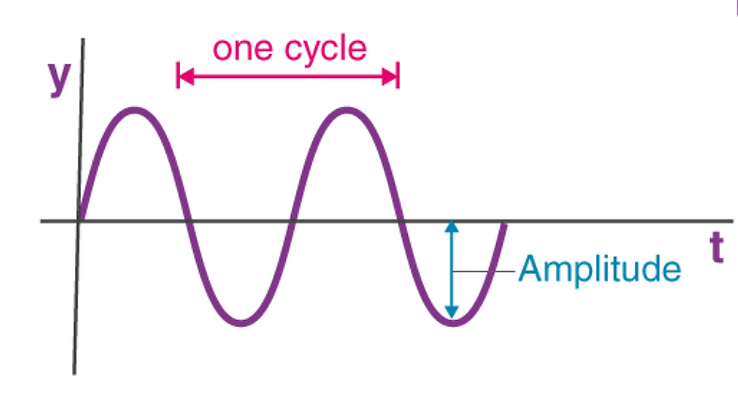

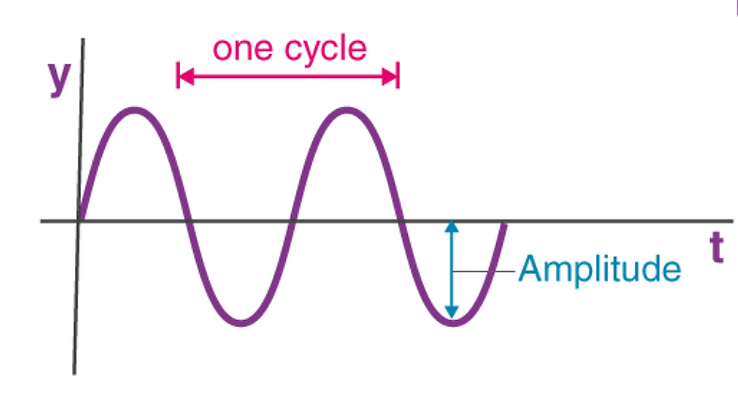

Novell advises on acquisition of network timing business

Novell is pleased to announce that its client, Orolia (www.orolia.com), successfully acquired Spanish networking technology company Seven Solutions (https://www.orolia.com/orolia-completes-acquisition-of-seven-solutions/).

Sales of Orolia Fleet Management to MetOcean Telematics

Novell is pleased to announce that its client, Orolia (www.orolia.com), successfully divested its fleet management business to MetOcean Telematics (www.metocean.com).

Why use an outsourced corporate development team?

This article covers the definition of the corporate development function, and how it can be utilized to implement a programmatic M&A approach. It discusses the teams involved with M&A execution and how, and in which situations, an outsourced corporate development team can help accelerate value creation.

Valuations when data is limited

There could be several reasons to perform a valuation of a business. The business might be for sale, it might be raising money or preparing an IPO, or it could be attempting to restructure debt. The business could also be in litigation and requiring an assessment of the case impact on the value of the business.

Novell advises on sale of Qulsar assets

Novell Corporate Development is happy to announce our support for the Qulsar, Inc. (www.qulsar.com) sale of assets to Viavi Solutions, Inc (www.viavisolutions.com). The asset purchase includes all Qulsar Systems Qg 2 variants and related development activities.

Novell support financial and deployment modeling for global leader in drone deliveries

At Matternet we design, build and operate drone delivery systems for the cities of the future. Over the last year, we’ve experienced an inflection point in the demand for our systems, driven by the need for fast and sustainable on-demand delivery in dense urban environments around the world.

Novell advises on acquisition of network timing business

Novell is pleased to announce that its client, Orolia (www.orolia.com), successfully acquired Spanish networking technology company Seven Solutions (https://www.orolia.com/orolia-completes-acquisition-of-seven-solutions/).

Sales of Orolia Fleet Management to MetOcean Telematics

Novell is pleased to announce that its client, Orolia (www.orolia.com), successfully divested its fleet management business to MetOcean Telematics (www.metocean.com).

Why use an outsourced corporate development team?

This article covers the definition of the corporate development function, and how it can be utilized to implement a programmatic M&A approach. It discusses the teams involved with M&A execution and how, and in which situations, an outsourced corporate development team can help accelerate value creation.

Valuations when data is limited

There could be several reasons to perform a valuation of a business. The business might be for sale, it might be raising money or preparing an IPO, or it could be attempting to restructure debt. The business could also be in litigation and requiring an assessment of the case impact on the value of the business.

Fill in the contact form to get in touch with us. We will reply back to you within 24 hours. You can also send us an email.

Palo Alto, California, United States